No change today for the Bank of Canada rate. You can read the full report here.

Here’s what the Bank of Canada is saying:

- The outlook has improved for both the global and Canadian economies. Activity has proven more resilient than expected in the face of the COVID-19 pandemic, and the rollout of vaccines is progressing.

- Global economic growth is stronger than was forecast in the January Monetary Policy Report (MPR), although the pace varies considerably across countries. The global recovery has lifted commodity prices, including oil, contributing to the strength of the Canadian dollar.

- In Canada, growth in the first quarter appears considerably stronger than the Bank’s January forecast, as households and companies adapted to the second wave and associated restrictions. Substantial job gains in February and March boosted employment. However, new lockdowns will pose another setback and the labour market remains difficult for many Canadians, especially low-wage workers, young people and women.

- The Bank will continue to monitor the potential risks associated with the rapid rise in house prices.

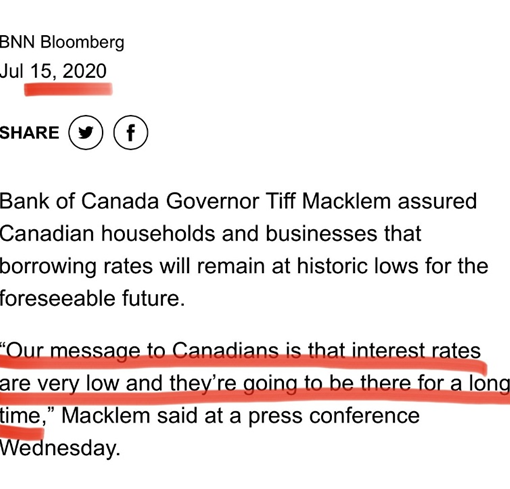

- Even as economic prospects improve, the Governing Council judges that there is still considerable excess capacity, and the recovery continues to require extraordinary monetary policy support. We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. Based on the Bank’s latest projection, this is now expected to happen some time in the second half of 2022.

A key area is the monitoring of the rise in house prices. There is concern with the amount of debt that buyers are taking on in order to purchase (win the bidding war) the home they want. Here’s a recent article about that situation. Canadians Are Piling on Debt to Chase Soaring House Prices

Let’s make sure you take advantage of the best mortgage rates available for as long as possible. Contact me to review your current mortgage or start planning for a new mortgage.