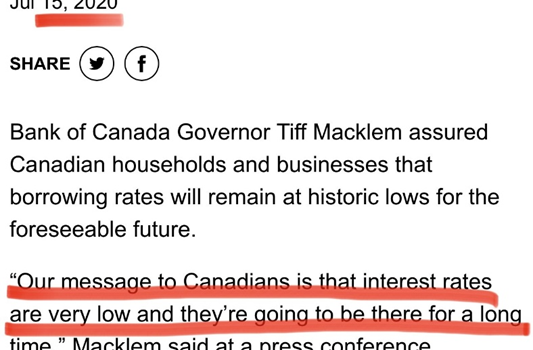

Hello, The Bank of Canada raised its key lending rate by 0.25% today. This increase affects mortgages and loans with variable or adjustable interest rates. This means most lenders will raise their prime rate to 7.20%. Watch Video Here for more information about the landscape of the current […]

Uncategorized

Spending time with family Charades with a Canadian Twist: Make up your own pictures to act out and have each one represent something Canadian, such as Beaver, Moose, Hockey, or a Landmark. Serve some Canadian foods: Some popular Canadian dishes that you can make right at home include – Poutine, […]

Renegotiating your mortgage at renewal time is an excellent way to save money and ensure that you have the best mortgage product for your financial situation. “51% of Canadian homeowners don’t plan on changing lenders when their mortgage comes up for renewal — and 9% weren’t even aware that they […]

I am so glad you have joined me here today to use my budgeting tool. I hope you find it to be very helpful. I put together a simple sheet for you to try: CLICK HERE. I usually recommend that you print off your bank & credit statements, to […]

When working on your pre-approval or approval, I will ask you for a variety of documents depending on how you earn income. There are many different tax documents, and it can get a bit confusing, so I have broken it down for you! Here are a few commonly requested tax […]

An annual mortgage statement is a document sent to a borrower by the mortgage holder. This statement provides the borrower with key information related to the loan, activity on the account, and the remaining balances owed or other financial obligations for which the borrower is responsible. A mortgage statement is […]

Each year many of us set New Year’s Resolutions in hopes of losing a few pounds, eating healthier, going to the gym more, quitting old habits etc., but have you ever made a New Year’s Resolution for your financial health and well-being? If you are needing help with budgeting your […]

1. Traditional Mortgage Traditional mortgages are available to borrowers who meet certain criteria, the most common of which is having a down payment equal to or more than 20 percent of the property’s value. 2. Open Mortgage With an open mortgage, you can pay off your loan in full or […]

If you’re gainfully employed and in a fixed rate mortgage, especially one taken at under 2%, you may well be saying, what pain? If you’re in a variable rate mortgage with a static payment, you may also be asking; what pain? We are after all a nation at, or near, full employment. […]

The Bank of Canada raised its key lending rate by 0.75% today. This means most lenders will raise their prime rate to 5.45%. Watch the video below to learn how this will affect your mortgage. If you are in a fixed rate mortgage, nothing changes for you. For Variable Rate […]